How to Hire a Freelance Financial Consultant

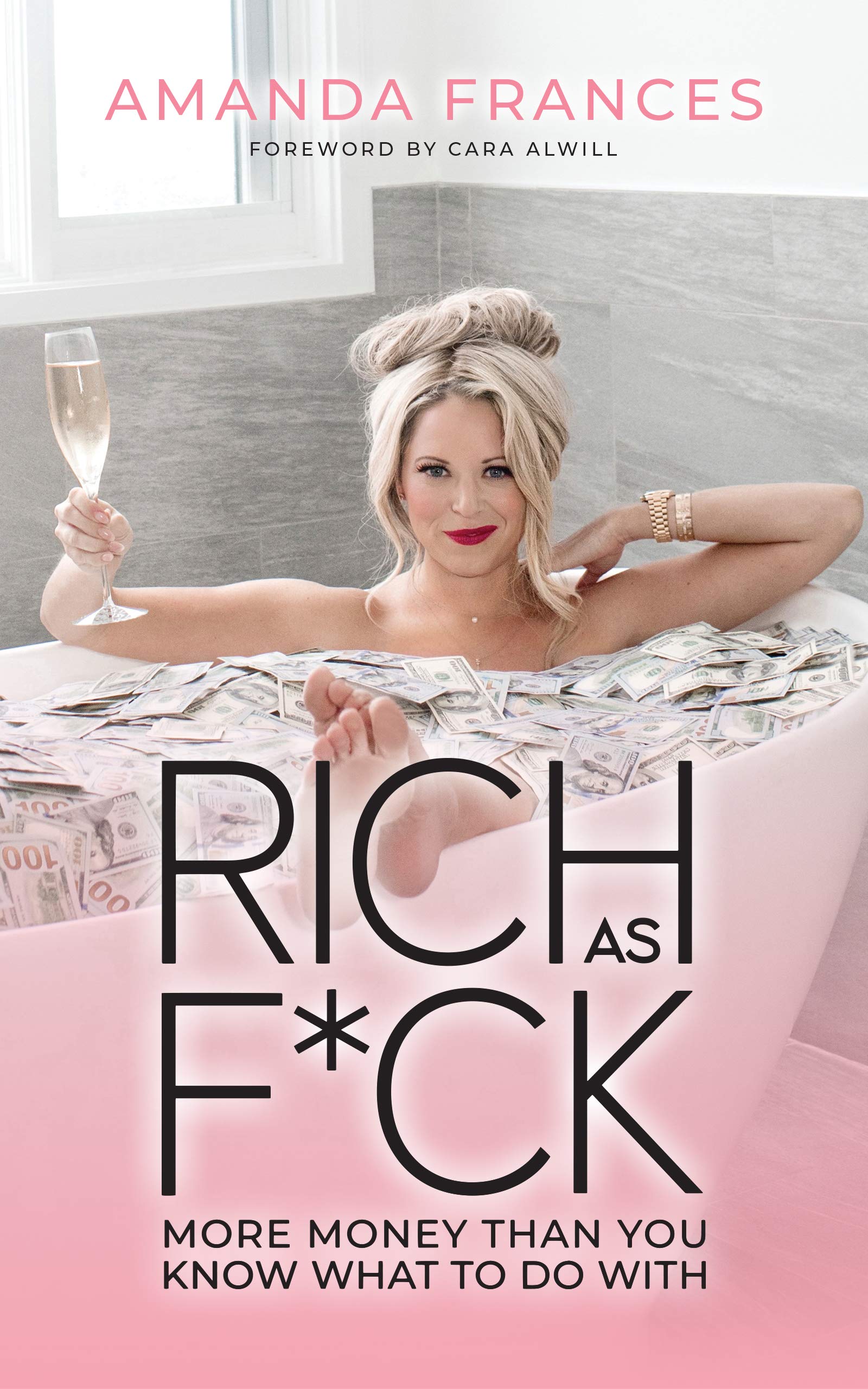

Are you looking for a Financial Consultant?

Click the pink button to learn more ...

Overview

Introduction to hiring a freelance financial consultant

Hiring a freelance financial consultant can be a game-changer for both individuals and businesses.

Whether you need assistance with financial planning, investment advice, or budgeting, a freelance financial consultant can provide valuable expertise and guidance.

With their flexible schedules and specialized knowledge, freelance consultants offer a cost-effective solution for those who require financial assistance but may not have the resources for a full-time hire.

In this article, we will explore the benefits of hiring a freelance financial consultant and provide tips on finding the right consultant for your specific needs.

Benefits of hiring a freelance financial consultant

Hiring a freelance financial consultant can offer numerous benefits for individuals and businesses alike.

Firstly, freelancers often bring a wealth of experience and expertise to the table, having worked with a variety of clients and industries.

This allows them to provide valuable insights and recommendations tailored to specific financial needs and goals.

Additionally, hiring a freelance financial consultant can be a cost-effective solution compared to hiring a full-time employee or engaging a traditional consulting firm.

Freelancers typically work on a project basis, allowing businesses to save on overhead costs such as benefits and office space.

Furthermore, freelancers offer flexibility and agility, as they can quickly adapt to changing market conditions and deliver results within tight deadlines.

Overall, hiring a freelance financial consultant can provide businesses with the expertise, cost savings, and flexibility needed to navigate the complex financial landscape and achieve their goals.

Key considerations before hiring a freelance financial consultant

When hiring a freelance financial consultant, there are several key considerations to keep in mind.

Firstly, it is important to thoroughly assess the consultant's qualifications and experience in the financial industry.

Look for certifications, relevant education, and a track record of successful projects.

Additionally, consider the specific expertise you require from the consultant.

Are you looking for someone with experience in a particular industry or with a specific skillset? It is crucial to find a consultant who can meet your unique needs.

Furthermore, take the time to evaluate the consultant's communication and interpersonal skills.

Effective communication is essential for a successful working relationship, so ensure the consultant has strong verbal and written communication abilities.

Lastly, consider the consultant's availability and flexibility.

Determine if their schedule aligns with your project timeline and if they can accommodate any changes or additional requirements that may arise.

By carefully considering these key factors, you can make an informed decision when hiring a freelance financial consultant.

Understanding Your Financial Needs

Assessing your financial goals and objectives

Assessing your financial goals and objectives is a crucial step in the process of hiring a freelance financial consultant.

Before you can find the right consultant for your needs, you must first have a clear understanding of what you hope to achieve financially.

This involves evaluating your short-term and long-term financial goals, as well as identifying any specific objectives you have in mind.

By taking the time to assess your financial goals and objectives, you can ensure that the consultant you hire has the necessary expertise and experience to help you reach your desired outcomes.

Identifying specific areas where you need assistance

When it comes to hiring a freelance financial consultant, it is crucial to identify specific areas where you need assistance.

This will help you find a consultant who specializes in those particular areas and has the expertise and knowledge to meet your specific needs.

Whether you require assistance with financial planning, investment management, tax planning, or any other financial aspect, clearly defining your needs will ensure that you hire the right consultant who can provide the necessary guidance and support.

By identifying these specific areas, you can streamline the hiring process and maximize the value you receive from the consultant's services.

Determining your budget for hiring a freelance financial consultant

Determining your budget for hiring a freelance financial consultant is an important step in the process.

Before you begin your search, it's crucial to have a clear understanding of how much you're willing to invest in this service.

Consider factors such as the complexity of your financial needs, the level of expertise you require, and the duration of the project.

By setting a realistic budget, you can ensure that you attract qualified candidates who align with your financial goals and objectives.

It's also important to remember that while cost is a significant factor, it shouldn't be the sole determinant in your decision-making process.

Quality and experience should also be taken into account when selecting a freelance financial consultant.

Finding the Right Freelance Financial Consultant

Researching and evaluating potential consultants

When researching and evaluating potential consultants, it is important to consider several factors.

First, you should assess the consultant's qualifications and experience in the financial industry.

Look for consultants who have a strong educational background, relevant certifications, and a proven track record of success.

Additionally, consider the consultant's area of expertise and whether it aligns with your specific financial needs.

It is also crucial to check the consultant's reputation and client testimonials to ensure they have a history of delivering high-quality results.

Finally, don't forget to evaluate the consultant's communication skills and responsiveness, as effective communication is key to a successful working relationship.

By thoroughly researching and evaluating potential consultants, you can make an informed decision and hire the right freelance financial consultant for your business.

Checking qualifications and experience

When it comes to hiring a freelance financial consultant, checking qualifications and experience is crucial.

You want to ensure that the consultant has the necessary knowledge and skills to handle your financial needs.

Start by reviewing their educational background and certifications.

Look for consultants who have relevant degrees or certifications in finance, accounting, or a related field.

Additionally, consider their professional experience.

Find out how long they have been working as a financial consultant and what types of clients they have worked with in the past.

This information will give you a sense of their expertise and ability to handle your specific financial requirements.

By thoroughly checking qualifications and experience, you can make an informed decision and hire a freelance financial consultant who is well-equipped to assist you.

Reviewing client testimonials and references

When hiring a freelance financial consultant, it is crucial to thoroughly review client testimonials and references.

These testimonials provide valuable insights into the consultant's expertise, professionalism, and ability to deliver results.

By reading about the experiences of previous clients, you can gain a better understanding of the consultant's strengths and weaknesses, as well as their track record of success.

Additionally, reaching out to references allows you to directly communicate with individuals who have worked with the consultant in the past, giving you the opportunity to ask specific questions and gather more detailed information.

Taking the time to review client testimonials and references can help you make an informed decision and choose the right freelance financial consultant for your needs.

Negotiating Terms and Rates

Defining the scope of work and deliverables

Defining the scope of work and deliverables is a crucial step when hiring a freelance financial consultant.

This involves clearly outlining the specific tasks and responsibilities that the consultant will be responsible for, as well as the expected outcomes and deliverables.

By defining the scope of work and deliverables, both the client and the consultant can have a clear understanding of what needs to be accomplished and can avoid any misunderstandings or miscommunications.

It also helps in setting realistic expectations and ensuring that the consultant has the necessary skills and expertise to meet the client's requirements.

Overall, defining the scope of work and deliverables is essential for a successful collaboration between the client and the freelance financial consultant.

Discussing payment terms and rates

When discussing payment terms and rates with a freelance financial consultant, it is important to establish clear expectations and ensure both parties are on the same page.

Begin by outlining the consultant's hourly rate or project fee, and discuss whether there are any additional charges for expenses or travel.

It is also essential to determine the payment schedule and method, whether it is a one-time payment or divided into installments.

Additionally, consider negotiating a contract that includes a clause for late payment penalties or early termination fees.

By openly discussing and agreeing upon payment terms and rates, both the consultant and the client can avoid any misunderstandings or conflicts in the future.

Negotiating a contract or agreement

When negotiating a contract or agreement with a freelance financial consultant, it is important to clearly define the terms and conditions of the engagement.

This includes outlining the scope of work, the duration of the project, and the payment terms.

It is also crucial to discuss any additional services or deliverables that may be required, as well as any potential risks or liabilities.

Open and transparent communication is key during the negotiation process to ensure both parties are on the same page and have a clear understanding of their responsibilities and expectations.

By establishing a solid contract or agreement, you can protect your interests and set the foundation for a successful working relationship with your freelance financial consultant.

Managing the Freelance Financial Consultant

Establishing clear communication channels

Establishing clear communication channels is crucial when hiring a freelance financial consultant.

Effective communication ensures that both parties are on the same page and have a clear understanding of expectations and deliverables.

It allows for seamless collaboration and the ability to address any concerns or questions that may arise throughout the project.

By establishing these clear communication channels from the start, you can create a strong foundation for a successful working relationship with your freelance financial consultant.

Setting expectations and deadlines

When it comes to setting expectations and deadlines for a freelance financial consultant, clear communication is key.

It is important to clearly define the scope of work, project requirements, and deliverables from the beginning.

This will help the consultant understand what is expected of them and ensure that both parties are on the same page.

Additionally, discussing and agreeing upon deadlines is crucial to ensure timely completion of the project.

By setting realistic deadlines and regularly communicating with the consultant, you can establish a productive working relationship and achieve the desired results.

Monitoring progress and providing feedback

Monitoring progress and providing feedback are crucial aspects of the freelance financial consultant hiring process.

Once you have hired a consultant, it is important to establish clear communication channels and set expectations for regular progress updates.

This ensures that you stay informed about the consultant's work and can provide feedback and guidance as needed.

Monitoring progress allows you to track the consultant's performance and make any necessary adjustments to the project timeline or scope.

Additionally, providing feedback is essential for fostering a productive working relationship and ensuring that the consultant understands your expectations and can make any necessary improvements.

By actively monitoring progress and providing feedback, you can maximize the value of your freelance financial consultant and ensure the success of your project.

Conclusion

Summary of the hiring process

The hiring process for a freelance financial consultant involves several key steps.

Firstly, it is important to clearly define the specific financial needs and goals of your business.

This will help you identify the expertise and skills required from a consultant.

Next, you can start searching for potential consultants through various channels such as online platforms, professional networks, and referrals.

Once you have a shortlist of candidates, it is crucial to thoroughly evaluate their qualifications, experience, and track record.

This can be done through interviews, reviewing their portfolio, and checking references.

After selecting the most suitable candidate, it is recommended to discuss the terms of the engagement, including the scope of work, payment terms, and confidentiality agreements.

Finally, it is essential to establish clear communication channels and ongoing monitoring to ensure the success of the consultancy engagement.

By following these steps, you can effectively hire a freelance financial consultant who will meet your business needs and contribute to your financial success.

Benefits of hiring a freelance financial consultant

Hiring a freelance financial consultant offers numerous benefits for individuals and businesses alike.

Firstly, freelancers often have a diverse range of experience and expertise, allowing them to provide tailored solutions to meet specific financial needs.

Additionally, hiring a freelance financial consultant can be more cost-effective compared to hiring a full-time employee, as freelancers typically charge on a project basis or hourly rate.

Moreover, freelancers offer flexibility and convenience, as they can work remotely and adapt to different time zones.

Lastly, engaging a freelance financial consultant allows for greater scalability, as businesses can easily adjust the level of support based on their current financial requirements.

Overall, the benefits of hiring a freelance financial consultant make it a valuable choice for those seeking professional financial advice and support.

Final thoughts and recommendations

In conclusion, hiring a freelance financial consultant can be a beneficial decision for individuals and businesses alike.

Their expertise and experience in the field can provide valuable insights and guidance, helping to navigate the complexities of financial planning and management.

By outsourcing financial consulting services, organizations can also save on costs and gain access to specialized knowledge without the need for a full-time employee.

However, it is important to thoroughly vet potential consultants and ensure they have the necessary qualifications and credentials.

Additionally, clear communication and expectations should be established from the beginning to ensure a successful working relationship.

Overall, with careful consideration and due diligence, hiring a freelance financial consultant can be a strategic move towards achieving financial success and stability.

Are you looking for a Financial Consultant?

Click the pink button to learn more ...